Horizon Equity Partners boasts a long, established track record in private equity, dating back to 1996.

Our business is focused on providing both equity capital and skills to South African shareholder managed enterprises. Our investors enjoy access to sustainable business sustainable business opportunities that offer healthy returns with significantly reduced risk.

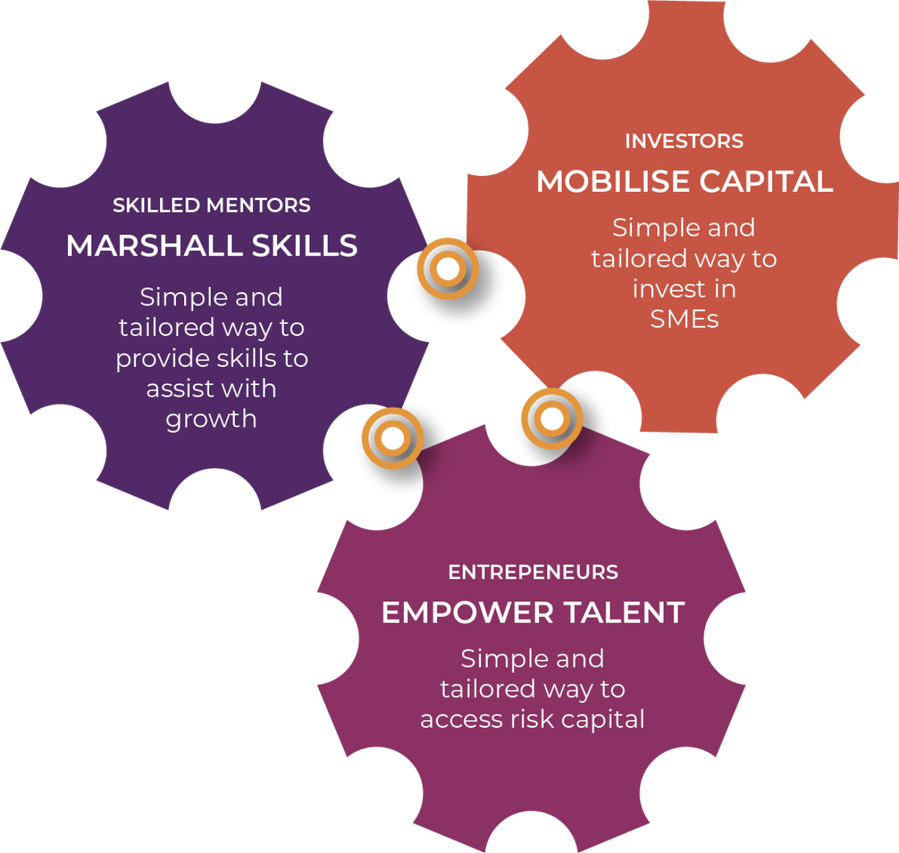

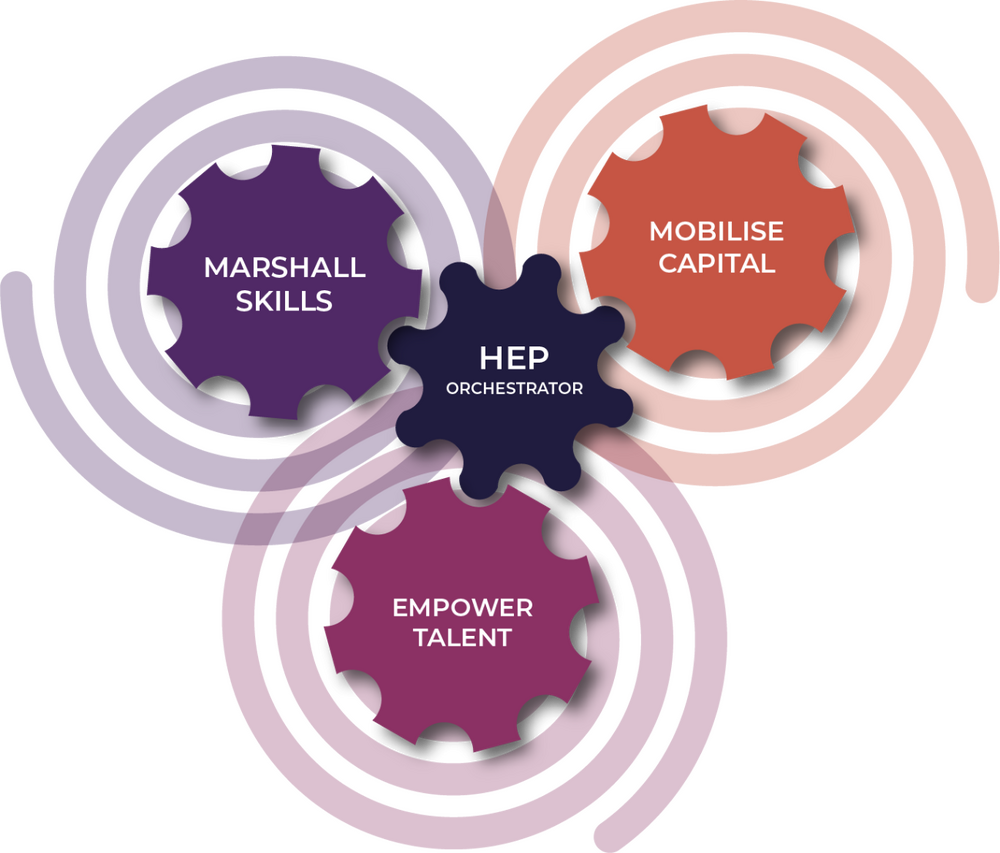

The Horizon Prosperity Orchestrator brings together entrepreneurs, investors and mentors, and addresses three critical gaps in the private equity ecosystem: the equity gap, the skills gap and the value gap.

Go to external page: Contact us

Who we are

Horizon Equity Partners is one of South Africa’s long-established private equity providers, having been founded in 1996.

Our business focuses on shareholder-managed enterprises with an enterprise value of less than R100-million. These businesses are vital to creating a vibrant, sustainable and competitive economy, yet struggle to attract traditional private equity investment. Until now, that is, thanks to our unique business model.

What we do

In a nutshell, we create shared prosperity: for entrepreneurs, for investors, for South Africans.

Entrepreneurs start businesses because they have a big idea, and they pour themselves into their ventures and are able to grow it to a point, but are then unable to achieve the next growth trajectory.

At Horizon Equity Partners, we’re inspired by that passion – and aim to provide the funding, and the business skills, to carry that enterprise through its next growth cycle towards a more profitable, sustainable future. We bring together entrepreneurs and mentors, backed by capital from investors, in a unique manner, enabling all parties to benefit.

We believe implicitly that appropriately funded and governed shareholder-managed enterprises have the capacity to make the South African economy more competitive, to improve productivity and deliver shared prosperity.

How we do it

The Horizon Prosperity Orchestrator model is designed to be simple, equitable, accessible and effective at reducing investment risk and delivering strong returns:

- We mobilise capital by providing investors with a platform to access exciting investment opportunities in the R5-million to R15-million equity investment range

- We marshal skills by pairing entrepreneurs with appropriate mentors and a governance programme, which boosts business success and reduces investment risk

- We empower talent, giving entrepreneurs what they need to grow their businesses into larger, more valuable enterprises, and deliver on their promise

Investor pain points

For investors, private equity is a long-term investment, in which risk must be managed and returns optimised.

The cost of investing into businesses with an enterprise value of less than R100-million has traditionally been too high, resulting in this sector being underserved in the traditional private equity model.

Pain points for investors in this regard include the friction costs of private equity – the direct and indirect costs associated with an investment coupled with the lack of transparency and misaligned interests which make many shareholder-managed enterprises uninvestable, in spite of their potential.

Investor benefits

For investors, private equity is a long-term investment, in which risk must be managed and returns optimised.

The cost of investing into businesses with an enterprise value of less than R100-million has traditionally been too high, resulting in this sector being underserved in the traditional private equity model.

Pain points for investors in this regard include the friction costs of private equity – the direct and indirect costs associated with an investment coupled with the lack of transparency and misaligned interests which make many shareholder-managed enterprises uninvestable, in spite of their potential.